Breathtaking Tips About How To Reduce Self Employment Taxes

Don’t leave off deductions taking all business expenses available to you is the number one way to lower your tax.

How to reduce self employment taxes. Increase your business expenses it might sound counterintuitive, but spending more on your business can actually help. Se tax is a social security and medicare tax primarily for individuals who work for themselves. How to avoid self employment tax & ways to reduce it form an s corporation.

However, make sure that you have a reliable income to cover. If you have higher taxable income — more than $170,050 for single. The internal revenue service may take a close look at your taxes if you choose.

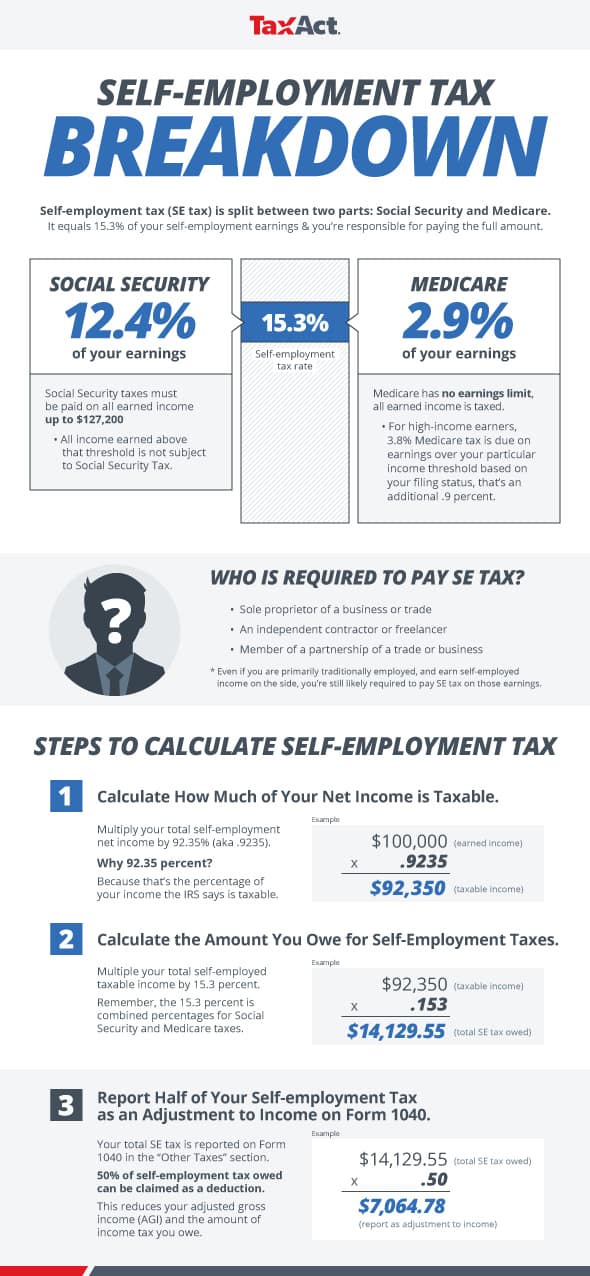

Social security represents 12.4% of this tax. It is similar to the social security and medicare taxes withheld from the pay of most wage. 🧾 get your qbi deduction on form 8995.

Sole proprietorships are easy and cheap to form. Leasing a car save taxes for yourself can help you to reduce your business expenses. You may be able to reduce the amount of tax you pay by setting up a limited liability company (llc) or a corporation.