Underrated Ideas Of Tips About How To Improve Credit History

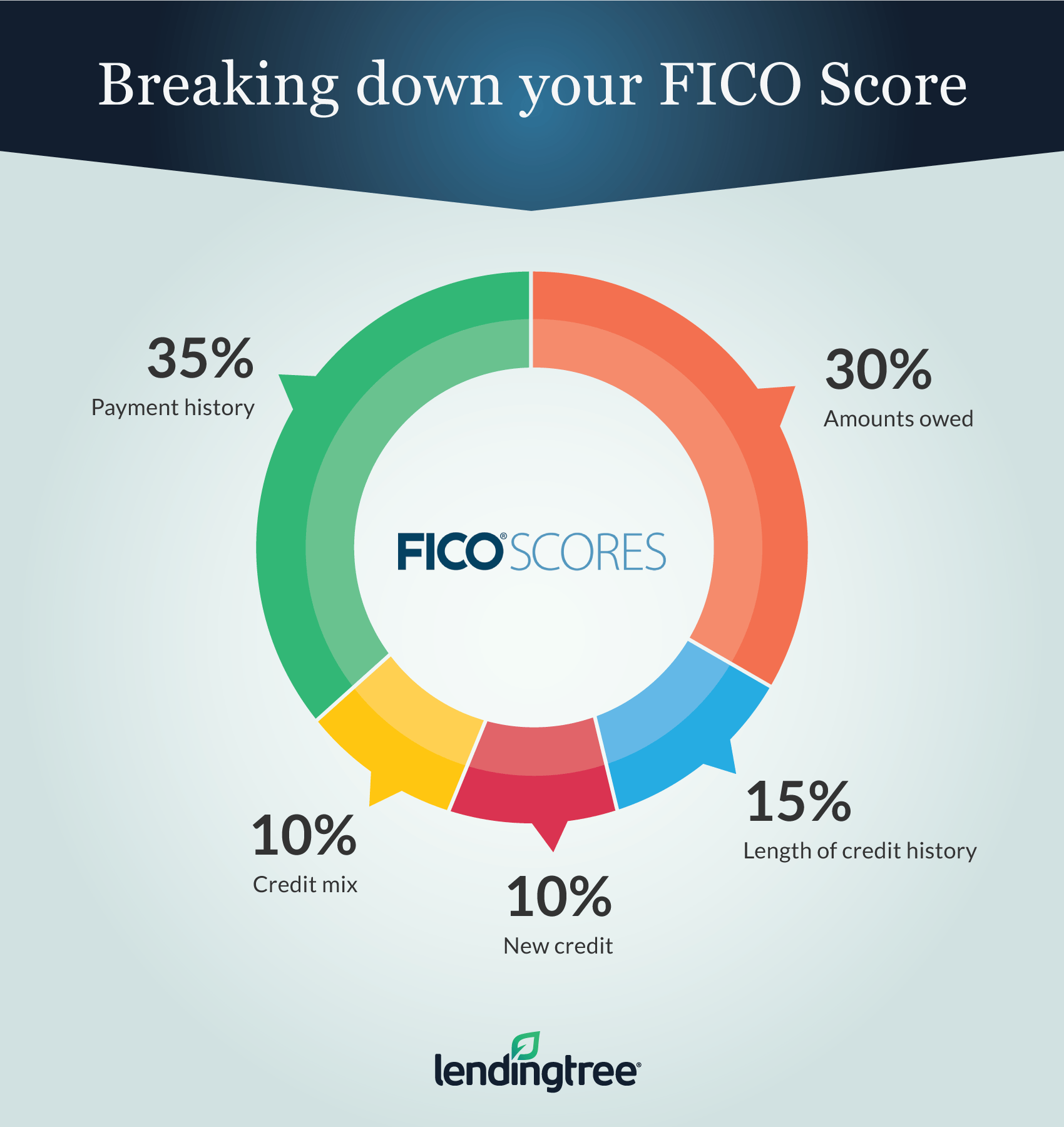

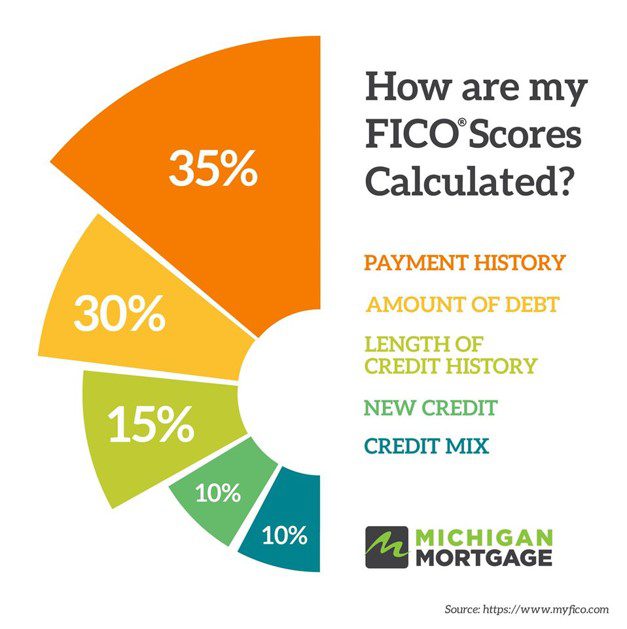

As the most important factor when calculating a consumer’s credit.

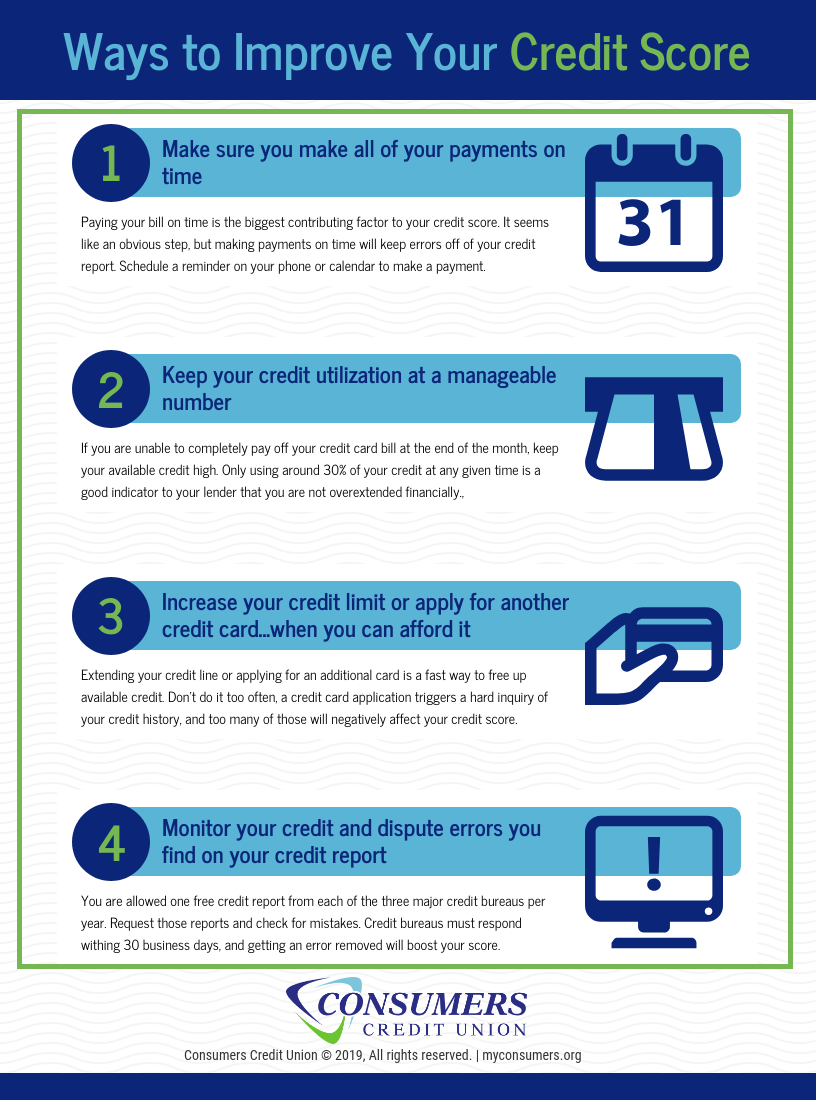

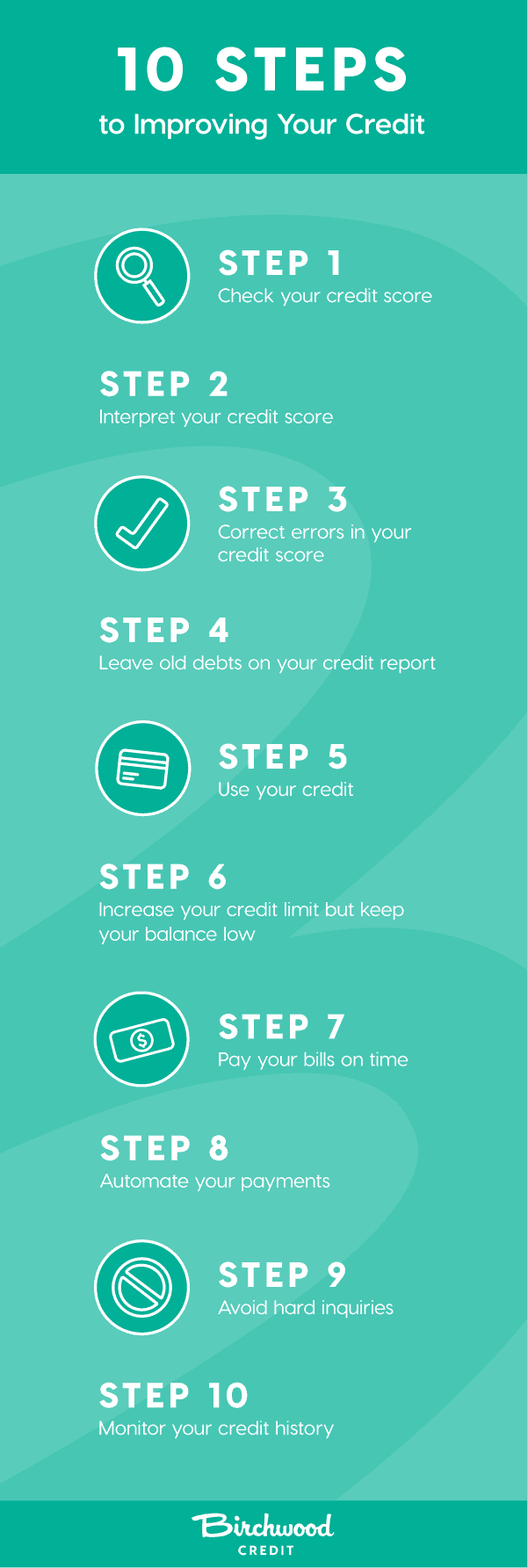

How to improve credit history. If you have bad credit history, improve your rating with all three of the major bureaus that issue credit reports by building good credit and checking your score regularly. Pay it off (after the statement date, before the. While the tips shared in the article will help you build a credit history and improve your credit.

That is, you should maintain a balance of no more than $3,000 on a credit card with a. Do you have utility bills in your name? Let’s quickly look at a few of your incentives to improve your insufficient credit history.

A credit score refers to a number that falls between 300 and 900. Becoming an authorized user on a family member's or friend's credit card is one way to build credit that doesn't involve applying for your own credit card. See our top 5 rated services and improve your credit score.

Find out where you stand. The higher your score, the greater your chances of being viewed as a. First, when you pay your full statement balance by the due date on your account, you can avoid paying expensive interest charges.

Find a card with features you want. Raise credit score, how to increase credit history, how to. The card must be secured with a credit line.

The average interest rate is 16.17% (based on. By creating an account, by building credit, or by creating a history. How to improve credit immediately, improve credit fast, improve credit history, how to improve credit score, sign in to credit one, credit cards to improve credit, how to get credit, improve.